By: Shelley Preisler

Due to state legislation enacted in 2022, cannabis retailers saw a significant increase to the state excise tax beginning July 1, 2025. However, the rate will return to 15% on October 1, 2025 due to Assembly Bill (“AB”) 564, a cannabis excise tax relief bill from Assembly Member Haney that was signed into law earlier this year.

Beyond the State cannabis excise tax, California cannabis retail businesses face heightened federal tax burdens pursuant to Internal Revenue Code (“IRC”) Section 280E, state sales tax, and widely varied taxes and fees depending on the particular municipality. Under this summer’s state excise tax increase, consumers could be subject to tax rates nearing 40% as tax amounts are “stacked” for the total amount due, driving many consumers to black market and hemp options, rather than shopping at tax revenue-generating licensed operators.

Key Takeaways

- From July 1, 2025 to September 30, 2025, the state excise tax for California cannabis retailers increased from 15% to 19%, but will return to 15% October 1, 2025 pursuant to AB 564.

- Cannabis retailers are unlikely to see federal relief in a now delayed attempt to reclassify cannabis at the federal level from Schedule I to Schedule III.

Cannabis Excise Tax: Increase July 1, 2025 until September 30, 2025

Beginning July 1, 2025, the state excise tax increased for California cannabis retailers from 15% to 19% of gross receipts. The increase resulted from the provisions of Assembly Bill (“AB”) 195 (2022), which shifted the responsibility for collection of cannabis excise tax from distributors to retailers; discontinued the cultivation tax; and provided for continual increases in the cannabis excise tax rate to generate the revenue that would have been collected under the discontinued cultivation tax, up to a 19% cap.

However, AB 564, a bill introduced by Assemblymember Matt Haney with the stated goal of immediate tax relief to the cannabis industry, decreases the excise tax effective October 1, 2025, re-imposing the 15% rate until June 30, 2028. The rate will be re-adjusted every two years beginning with the 2028-2029 fiscal year to make up for the revenue that would have been generated under the discontinued cultivation tax, up to a 19% cap.

IRC Section 280E Will Continue to Apply to Cannabis Businesses for the Indefinite Future

In addition to state and local taxes, cannabis businesses across the nation are subject to a higher federal tax burden than other industries; IRC Section 280E (“280E”) prohibits state-legal cannabis operators from taking standard business deductions, including rent, wages, marketing, insurance, and professional services. As a result, cannabis businesses are subject to significantly higher federal tax rates than other business types, averaging around 70% higher for cannabis retailers.

Under the Biden administration’s proposal to reschedule cannabis from Schedule I to Schedule III, the cannabis industry would have been exempted from 280E. This is because 280E applies only to businesses handling Schedule I and II controlled substances, not Schedule III substances. However, hearings on rescheduling were paused indefinitely earlier this year, and despite mixed messaging from Trump and other individuals in leadership positions, cannabis reform is unlikely to be a priority of the Trump administration.

Effect on Operators

According to analysis by SFGate in early 2025, inactive and/or surrendered California commercial cannabis licenses now surpass active permits. Stark competition and heavy tax burden at all levels of government are only a handful of the many problems faced by the State’s cannabis industry. In addition to the state excise tax, cannabis retailers are subject to the following taxes:

- State Sales Tax. This tax applies to adult use, but not medicinal, cannabis retail sales. Gross receipts for the purposes of calculating the state sales tax include the state cannabis excise tax and local cannabis taxes. Because the sales tax rate accounts for the state tax rate of 7.25% and the applicable local and district tax rates, the applicable sales tax rate varies by jurisdiction.

- Local Taxes. Municipalities may impose local cannabis taxes with voter approval. Municipalities which implement a local cannabis tax on retailers generally do so through a percentage of gross receipts, as defined in the local jurisdiction.

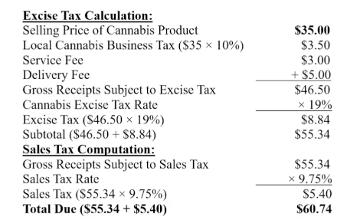

An example from the Cannabis Business Times referencing materials from the California Department of Tax and Fee Administration (“CDTFA”) is shown below of a tax calculation for a delivery purchase in a jurisdiction with a 10% local tax, reflecting the increased 19% state excise tax, demonstrating the impact of stacked tax burden on the ultimate price paid by consumers:

Figure 1. Sample Cannabis Retailer Tax Calculation

According to a report by the Department of Cannabis Control (“DCC”) in 2025, only approximately 40% of cannabis consumed in California is obtained from the licensed, regulated marketplace, meaning the majority of cannabis comes from the “black” unlicensed, unregulated market. Because the price of cannabis sold in legal dispensaries is often two to three times higher than nearly identical items sold by unlicensed shops, legal operators struggle to compete against illicit operators and the federally-legal hemp industry (intoxicating hemp products have been banned in California, but are still widely available through online marketplaces and brick-and-mortar smoke shops).

When considering local cannabis tax rates and potential revenue streams from a regulated cannabis program, municipalities should consider state and federal tax burdens borne by operators and passed on to consumers, and the market share of potential cannabis tax revenue lost when consumers turn to cheaper black market and hemp alternatives.